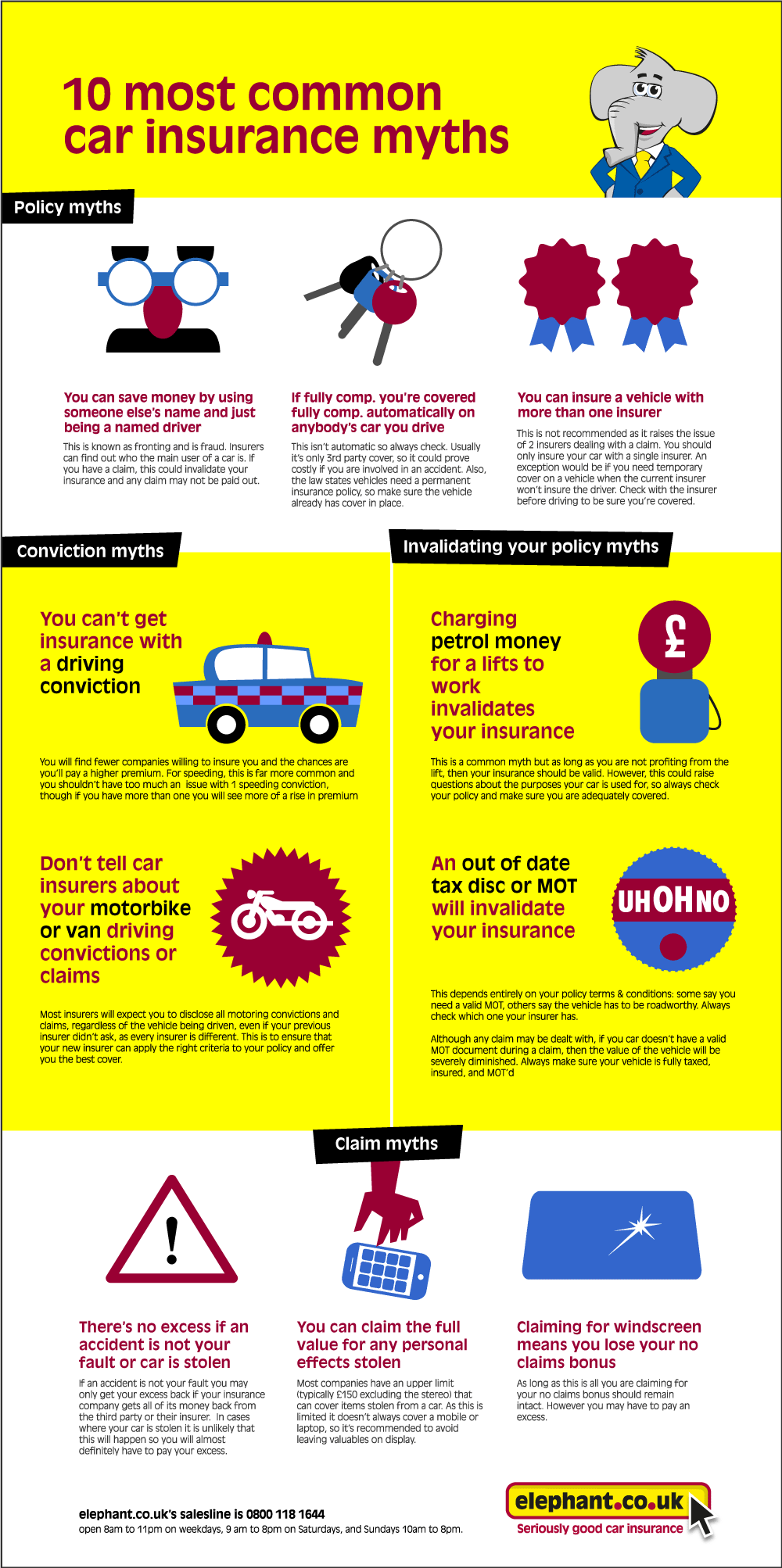

Glass Coverage If you live beside a golf links, you may have located on your own desiring you had glass protection to spend for the expense of repairing or changing the home windows on your vehicle. Some insurer use glass insurance coverage with no deductible, but the price of the added insurance coverage might exceed the advantages, specifically with some plans only covering the windshield.

That makes a lot more feeling! Whatever you end up doing, there are lots of means to reduce auto insurance coverage. And also if you have actually listened to of something called a "going away deductible," no, it's not a magic method. Your payments definitely won't vanish into slim air. Some insurance coverage firms supply going away deductibles at an additional expense for chauffeurs with a long background of safe driving.

So if your insurance deductible is $500 as well as you've been accident-free for 5 years, your deductible would most likely to $0. The deductible comes back in complete the 2nd you obtain into a crash. Ta-da! Factoring in the added expense of the protection, you're usually much better off conserving that cash to place towards your financial obligation snowball or reserve - affordable auto insurance.

If you remain out of problem momentarily, your premiums will ultimately come back down to planet. One more thing that can create your premium to go up is if you're frequently filing insurance claims. So if you have $250 well worth of work thanks to a fender bender, you might not want to file that claim.

Get This Report on Auto Insurance - Oci.ga.gov

Your objective is to find your cars and truck insurance coverage pleasant area. The ideal way to do this is by working with an independent insurance coverage agent that is part of our Supported Neighborhood Providers (ELP) program.

For the more than 276 million vehicles when driving today, automobile insurance coverage is legally controlled to manage drivers and passengers monetary protection. Prior to you can lawfully operate an automobile in most states, you need to buy a minimum amount of car insurance policy. Nonetheless, prior to you can acquire a brand-new auto insurance plan, you need to recognize exactly how automobile insurance coverage works.

But after purchasing, just how does vehicle insurance policy job? You will require to pick the type of coverage that you require, including policy limits for damages as well as injuries (laws). With full protection, you will certainly additionally require to pick a deductible, which is the amount you pay after an accident before your insurance policy protection action in to aid with your claim.

auto insurance auto insurance auto insurance credit

auto insurance auto insurance auto insurance credit

Your insurance expert can supply you with this details, however it usually includes a "evidence of insurance claim" report and a duplicate of the authorities report. Display your insurance claim progress with the insurance coverage business and be certain to follow up with your case specialist. risks.

Facts About How Car Insurance Works - You Need A Budget - Ynab Revealed

While Louisiana pays the most for automobile insurance coverage at $2,724 per year, Maine has the most affordable full insurance coverage rate, averaging $965 per year.

How much cars and truck insurance coverage do you need?

money money trucks cars

money money trucks cars

These include your: Vehicle driver's permit (both for you and also for individuals you anticipate to be driving your insured vehicles) Car registration Social Safety number Banking details Car identification number (VIN) It additionally helps to have a duplicate of the existing declaration web page, as this details current insurance protection on any kind of automobiles for which you need a new quote - auto insurance.

With numerous various protections, it's tough to recognize what's right for you. Recognizing the different types of insurance coverages can assist you locate the best auto insurance policy plan for your demands and budget. Discover kinds of auto insurance policy protection with GEICO (cars). What is cars and truck insurance? Vehicle insurance aids supply economic security for you, your family, various other passengers, and also your lorry.

Our Motor Insurance: How Car Insurance Works - Car.co.uk Faqs Statements

Purchasing automobile insurance is very easy and also rapid with GEICO. Find out more concerning just how car insurance policy prices are figured out. Types of Cars And Truck Insurance Policy Coverage First, allow us make clear that there's no such thing as "complete insurance coverage." Some individuals might state "complete coverage" means the minimum liability insurance coverages for their state, thorough protection and also collision coverage.

Extra Vehicle Insurance Coverage Protections There's a whole lot to find out concerning automobile insurance policy coverages. Just how much vehicle insurance do I require? The right quantity of auto insurance coverage comes down to your requirements, budget, and also state requirements.

We motivate you to talk to your insurance policy agent as well as to review your plan agreement to fully recognize your insurance coverages. auto. * Some discount rates, coverages, layaway plan and functions are not readily available in all states or all GEICO companies. Insurance coverage undergoes the terms, restrictions as well as problems of your policy agreement.

Insurance policy has actually been simplified with the arrival of new-age digital insurance policy business. Now, possible insurance policy holders do not have to depend upon agents to aid them understand the subtleties of an insurance policy.

The Main Principles Of Car Insurance By Lemonade - Protect Your Car, Help The Planet

Stopping working to do so will total up to penalties. Going by the variety of vehicles when driving and also the price of crashes, it is imperative to make the appropriate choice when it involves purchasing automobile insurance policy protection. Sorts Of Vehicle Insurance Coverage in India: Listed here are both choices when it involves picking an auto insurance plan.

It not only consists of the attributes offered by a Liability-only plan however likewise provides Own Damage cover. This suggests you are guaranteed if your cars and truck triggers problems to others, and additionally if it is damaged by others or natural disasters. What Is Covered In A Cars And Truck Insurance Plan? Below's the solution to what does vehicle insurance cover in India? For an exact checklist of insurance coverage, describe the corresponding Policy Wordings.

When you've determined the very best method to connect, call your insurer or representative. 3Settle the Insurance Claim, Coordinate with your claims adjuster, the individual designated to manage your case. See to it to get your adjuster's get in touch with information as they will certainly be in charge of checking out the mishap as well as examining the quotes for lorry repair work and insurance claims settlement (cheaper car).

How Does a Deductible Work? Numerous aspects affect the cost of your vehicle insurance. One of these is your deductible or the cost of damages you're accountable for when you file a claim. Unlike in medical insurance, you need to pay an automobile insurance policy deductible for each claim. Having a higher deductible normally causes lower insurance premiums because you will certainly be paying even more out-of-pocket when you file an insurance claim.

What Does What Is Auto Insurance? - Iii Mean?

You have to pay $500 out-of-pocket, while your insurer will cover the continuing to be $5,500. What Auto Insurance Policy Insurance Coverage Do You Need? Each state has its very own laws that determine the minimum vehicle insurance coverage needs that every chauffeur must have. The majority of states need some form of responsibility insurance coverage. However, other states call for PIP or uninsured/underinsured vehicle driver insurance coverage.

Note that a state minimum insurance coverage will only offer standard protection. While this will certainly ensure conformity with state regulations, it does not identify just how much insurance coverage you need to buy. A liability-only policy will not cover you and also your vehicle in the event of a crash, so we extremely recommend purchasing additional thorough and crash coverage - insured car.

cheap car insurance cheaper car insurance car insured car insured

cheap car insurance cheaper car insurance car insured car insured

However, the actual expense of car insurance coverage will vary per individual. Insurance policy providers use specific aspects, like area, ZIP code, age, gender, credit history, driving history and insurance coverage degree to establish premiums for each and every policyholder. HOW TO MINIMIZE CAR INSURANCEDrivers can save money on automobile insurance policy by looking around and also contrasting quotes, keeping a tidy driving background as well as improving their credit rating.

See which business provide the ideal house and car package price cuts with our helpful evaluation and also positions. Where Do You Purchase Car Insurance Policy? Before choosing an insurer, you have to establish what you desire in an insurance company. Generally, insurance coverage companies offer similar core insurance coverages. Your choice will depend on just how much you worth cost versus quality of service.

All About How Does Car Insurance Work? - Coverage.com

Cash, Geek accumulated average prices from different business to figure out the most inexpensive vehicle insurance firms. Others might choose a firm supplying an equilibrium in worth and top quality service. Cash, Nerd also created a vehicle insurance coverage overview that rated the ideal automobile insurance policy. Contrast Insurance Rates, Guarantee you are obtaining the very best rate for your insurance policy.

Find out more Regarding Auto Insurance Policy, Vehicle Insurance, Vehicle Insurance, About the Author (insurance).

If you're a new motorist, don't be ashamed to confess that you're not sure just how automobile insurance policy works. The principle of auto insurance policy is that all motorists pay for economic protection.

It will cover, as a minimum, damage caused by you or your guests to others. It may also cover your automobile if it is swiped or set on fire, in addition to repair services to or replacement of your own car. There are three main sorts of vehicle insurance coverage, which are laid out listed below.

Understanding Automobile Insurance Fundamentals Explained

accident trucks insurance company cheap insurance

accident trucks insurance company cheap insurance

It just covers damage triggered to 3rd parties by you or your passengers. It omits cover for fire damages or if the cars and truck is stolen. Third party, fire and also theft This is the exact same as 3rd party only cover, however likewise includes defense in case of a fire or the burglary of your car (insurance companies).

Exactly how is the insurance coverage cost calculated? A number of elements are considered by insurance providers when they exercise your insurance coverage costs. Extensively speaking, the higher the danger, the more you will pay - auto. They will certainly ask your age, occupation, where you live, the make and design of your auto, as well as whether it has any kind of modifications or protection features.

Somebody in their 50s who works in a workplace, lives in a rural location, drives a cars and truck that belongs to a reduced insurance policy group, and also has never ever had a mishap or made a claim is most likely to obtain a really good rate. By comparison, someone under 25 that lives in a city, drives a quick auto, and has recently had a crash will certainly pay much more (vans).

When it involves automobile insurance policy, determining when you are and aren't covered by your car insurance policy can be complicated. Among the largest inquiries Californians have about auto insurance coverage is whether the insurance coverage covers the individual driving the automobile or whether it sticks with the vehicle(s) noted on the policy.

Some Known Incorrect Statements About How Does Car Insurance Work? Informative post - Aami

This blog will look at whether insurance coverage adheres to the automobile or the driver in California. auto insurance. There is no solitary response to this inquiry; nevertheless, in most cases, cars and truck insurance policy tends to comply with the auto it covers as opposed to the driver. If you let another person drive your car and they obtain in a crash, your insurer would likely be accountable for paying the case, depending upon the coverages in your plan.

Whenever a person is driving your car with your permission, your auto insurance will be main. This suggests that if the liberal motorist gets in a crash, your car insurance coverage will cover the damages in much the same method as though you were driving it.

There are some exemptions to this. Your insurance coverage may not cover the damages from an accident of a permissive chauffeur if they: Do not have a driver's certificate Drive under the impact of medications or alcohol If a person obtains your vehicle without your approval as well as causes a mishap, after that they would be liable for the damages (affordable).

If somebody is provided as a left out chauffeur on your policy, after that they're specifically excluded from your auto insurance. This indicates that if that person drives your automobile, your insurance coverage will not cover any type of damage that occurs. As we stated above, auto insurance policy usually follows the car, however this is not always the situation. cheap.

Get This Report about Michigan's Auto Insurance Law Has Changed

When a motorist obtains an auto and creates a mishap, the car's owner's automobile insurance is the main insurance policy, but if the driver has their very own insurance too, after that it will function as the additional coverage. So, if the damages caused surpasses the restrictions of the owner's liability protection, then the motorist's own liability insurance coverage would cover the rest of the expenses (cheap).